Gold Price Forecast: XAU/USD pokes $1,935 hurdle as market brace for US inflation – Confluence Detector

- Gold Price pares weekly losses at the lowest level in a month, seesaws around intraday top of late.

- Receding fears about China, positioning for US inflation allows XAU/USD to recover.

- Risk catalysts eyed for clear directions amid a light calendar, banks, economic slowdown in focus.

- XAU/USD bulls prod intermediate hurdle but lack conviction below $1,955 resistance confluence.

Gold Price (XAU/USD) clings to mid gains during the first positive day of the trading week as market sentiment improves amid mixed signals from China. Adding strength to the XAU/USD rebound could be the trader’s preparations for Thursday’s all-important US inflation gauge, namely the Consumer Price Index (CPI) for July.

The improvement in China’s factory-gate inflation, namely the Producer Price Index (PPI), joins risk-positive news from the Biden Administration, cited by Bloomberg, to tame the market’s previous pessimism despite the downbeat China Consumer Price Index (CPI).

That said, Italy’s surprise tax on the bank’s windfall profits, the global rating agencies’ downward revision of the US banks and financial institutions weighed on the sentiment on Tuesday and dragged the Gold Price towards refreshing the monthly low. On the same line could be fears of the UK recession and slowing economic growth in China, not to forget Beijing’s geopolitical tension with Japan and the US.

Looking ahead, a lack of major data/events may allow the Gold traders to consolidate the weekly loss before Thursday’s all-important US CPI. Should the US inflation data suggest easing price pressure, the XAU/USD may extend the latest rebound.

Also read: Gold Price Forecast: XAU/USD bounces but not out of the woods yet

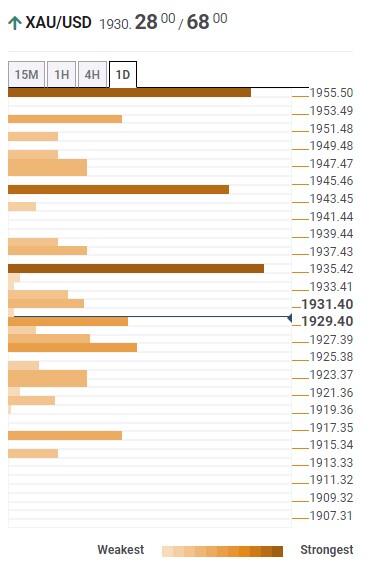

Gold Price: Key levels to watch

As per our Technical Confluence indicator, the Gold Price stays below the triple-resistance band that restricts the short-term XAU/USD upside below $1,955 mark.

Among them, $1,935 appears the immediate incentive for the XAU/USD buyers as it comprises 5-DMA, Pivot Point one-day R1 and Fibonacci 61.8% on one-month.

Following that, the Gold buyers can aim for the $1,945 resistance including Fibonacci 38.2% on one-week, Pivot Point one-day R2 and 50-DMA.

However, the XAU/USD remains on the bear’s radar unless crossing the $1,955 key upside hurdle encompassing the Fibonacci 61.8% on one-week, the middle band of the Bollinger on one-day and Fibonacci 38.2% on one-month.

Should the Gold Price extends the latest run-up beyond $1,955, it can challenge the $1,985 resistance area comprising multiple tops marked since May.

Alternatively, the previous weekly low joins the lower band of the Bollinger on the Daily chart and Fibonacci 23.6% on one-day to highlight $1,925 as immediate support for the Gold sellers to watch during the quote’s fresh fall.

Following that, the Pivot Point one-month S1 near $1,915 will act as the last defense of the Gold buyers before directing the bears toward the $1,900 threshold.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.