NZD/USD Technical Analysis: Kiwi sidelined near 0.6740 ahead of RBNZ

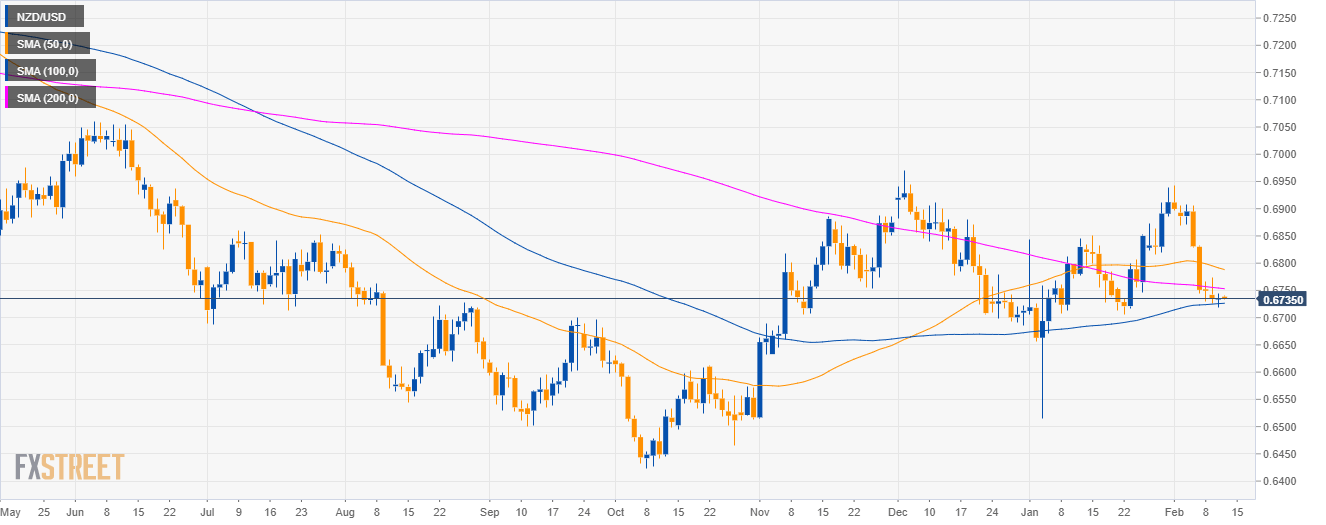

NZD/USD daily chart

- NZD/USD is trading between the 100 and 200-day simple moving average (SMAs).

- The Reserve Bank of New Zealand (RBNZ) will release its interest rate decision and monetary policy statement at 1.00 GMT. This can lead to high volatility in the NZD/USD currency pair.

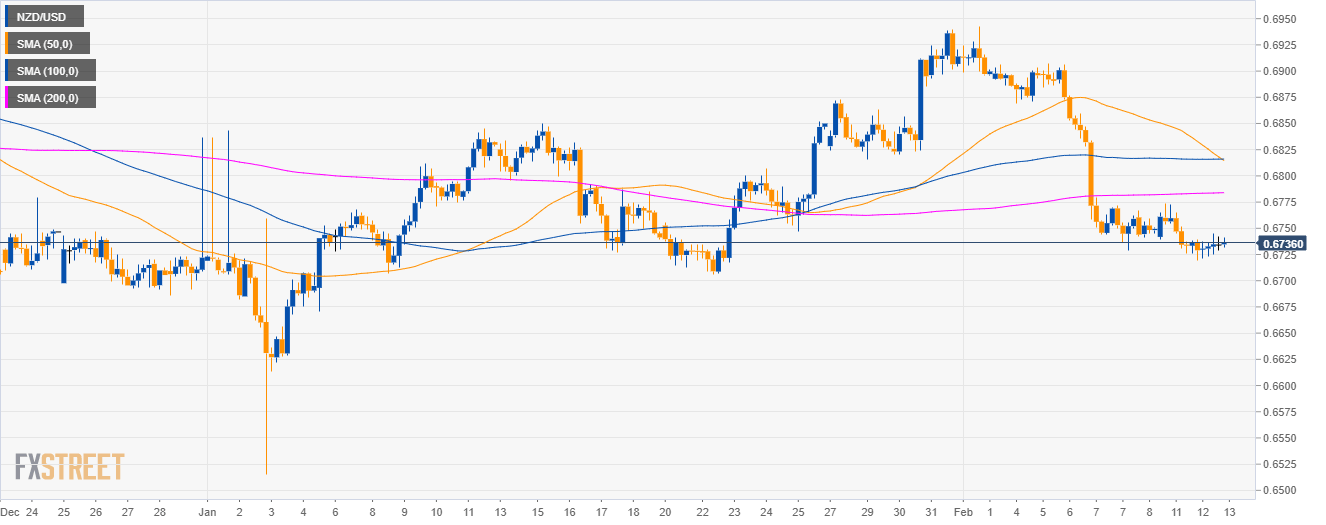

NZD/USD 4-hour chart

- NZD/USD is trading below its main SMAs suggesting bearish momentum in the medium-term.

NZD/USD 30-minute chart

- NZD/USD is trading below its 200 SMA suggesting bearish momentum in the short-term.

- Bears have to break below 0.6710 in order to travel towards 0.6645 and 0.6600 support.

- On the flip side, if bulls break 0.6775 they can drive the market all the way up to 0.6900 figure.

Additional key levels

NZD/USD

Overview:

Today Last Price: 0.6737

Today Daily change: 2 pips

Today Daily change %: 0.03%

Today Daily Open: 0.6735

Trends:

Daily SMA20: 0.6809

Daily SMA50: 0.6795

Daily SMA100: 0.6725

Daily SMA200: 0.6756

Levels:

Previous Daily High: 0.6774

Previous Daily Low: 0.6726

Previous Weekly High: 0.6907

Previous Weekly Low: 0.6729

Previous Monthly High: 0.694

Previous Monthly Low: 0.6516

Daily Fibonacci 38.2%: 0.6744

Daily Fibonacci 61.8%: 0.6756

Daily Pivot Point S1: 0.6716

Daily Pivot Point S2: 0.6697

Daily Pivot Point S3: 0.6668

Daily Pivot Point R1: 0.6764

Daily Pivot Point R2: 0.6793

Daily Pivot Point R3: 0.6812