EUR/SEK in 5-day lows near 10.4400 post-Riksbank

- The cross drops further after Riksbank left rates unchanged.

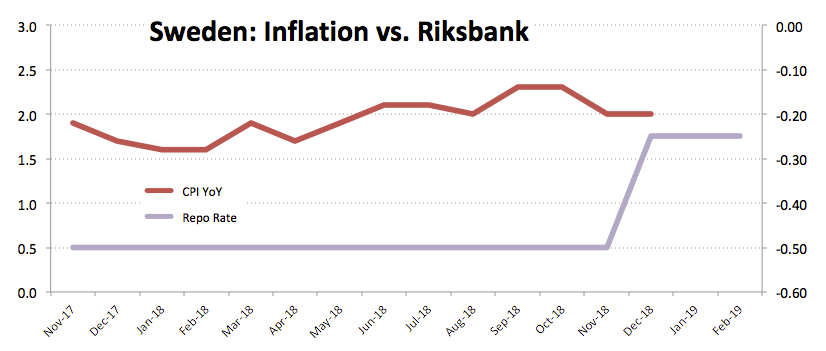

- The Riksbank keeps the key rate at -0.25%, in line with consensus.

- The central bank still sees inflation around 2% in coming years.

The Swedish Krona is gathering extra pace on Wednesday following the Riksbank decision on rates, dragging EUR/SEK to fresh lows in sub-10.4400 area.

EUR/SEK offered on steady Riksbank

SEK’s appreciation remains well and sound today after the Riksbank left the repo rate unchanged at -0.25% at today’s meeting, matching the broad consensus among investors.

The Scandinavian central bank acknowledged the prospects of slower pace in domestic economic growth and overseas, although it stressed the economic activity remains strong.

Regarding inflation, the central bank expects consumer prices to keep orbiting around the 2% target in the coming years. Furthermore, the Riksbank still sees the case for a rate hike in the second half of the current year.

What to look for around SEK

Fundamentals in the Nordic economy remain healthy, although the projected global slowdown is expected to have its say on the performance of the GDP in Q4 2018/Q1 2019. In addition, SEK is also facing extra headwinds as market participants consider it a funding currency in carry trade. Following the ‘dovish’ hike in December and subsequent messages from the central bank in the same direction, one can assume that a fairly amount of negative news should be already priced in around the Krona. However, concerns over the global slowdown and the ‘wait-and-see’ mode from the ECB should prompt some caution in the Riksbank, pouring cold water over speculations of further tightening this year and thus keeping rallies in SEK somewhat limited.

EUR/SEK levels to consider

As of writing the cross is losing 0.37% at 10.4409 and a break below 10.4363 (10-day SMA) would open the door to 10.3594 (21-day SMA) and finally 10.3356 (200-day SMA). On the flip side, the next hurdle emerges at 10.5154 (2019 high Feb.8) seconded by 10.5363 (monthly high Oct.11 2018) and then 10.6924 (monthly high May 3 2018).