Back

21 Aug 2019

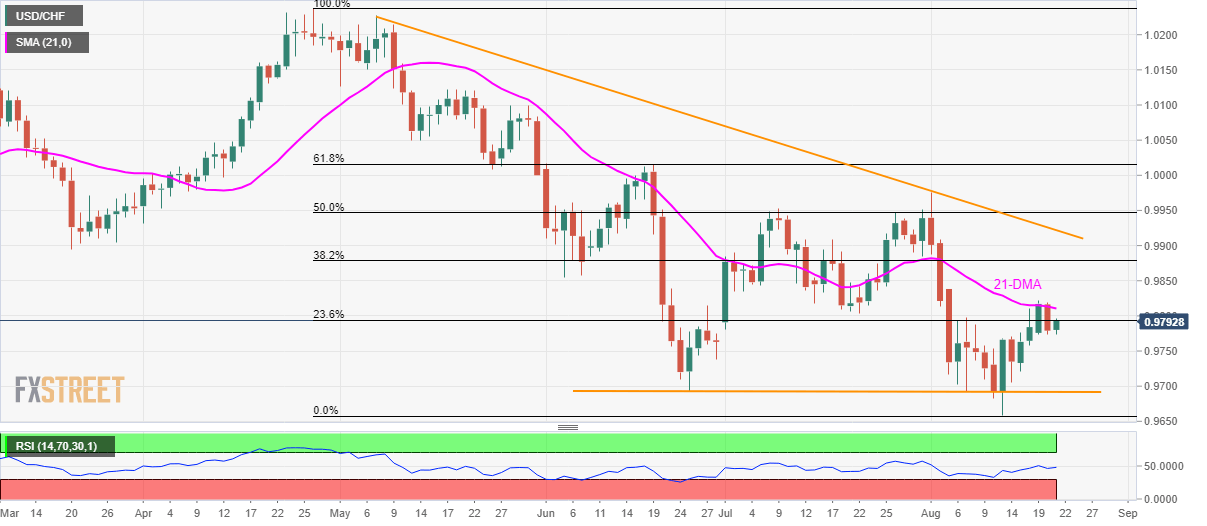

USD/CHF technical analysis: 21-DMA exerts downside pressure

- USD/CHF pulls back to 23.6% Fibonacci retracement.

- 21-DMA limits near-term upside.

Following its U-turn from the 21-day simple moving average (DMA), USD/CHF confronts 23.6% Fibonacci retracement of April-August declines as it takes the bids to 0.9793 ahead of the European session on Wednesday.

While 14-bar relative strength index (RSI) shows normal condition, pair’s sustained run-up beyond 0.9800 enables it to challenge the short-term key DMA level of 0.9811.

It should, however, be noted that the pair’s successful rise above 0.9811 can extend the rise to 38.2% Fibonacci retracement level around 0.9880.

During the pullback, 0.9770 and 0.9740/37 can offer intermediate halts ahead of highlighting 0.9690 horizontal support comprising lows marked in June and also tested during early-month.

USD/CHF daily chart

Trend: Bearish