Back

2 Oct 2019

US Dollar Index Technical Analysis: The ongoing correction is seen as temporary

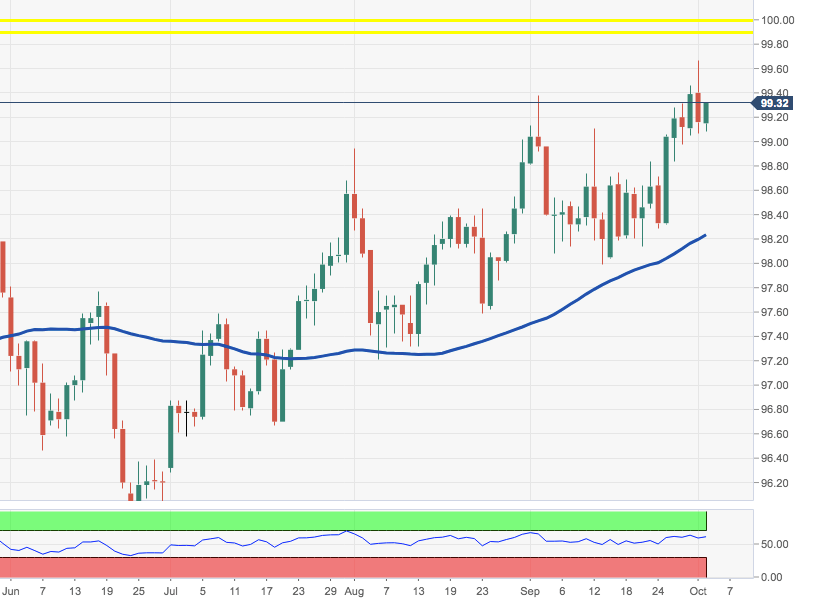

- DXY eased from recent YTD tops near 99.70 following the miserable print from the September’s US ISM manufacturing. Minor contention emerges at the 10-day SMA at 98.90 and the 21-day SMA at 98.60.

- The continuation of the buying pressure in the buck should see the May 2017 high at 99.89 re-tested ahead of a visit to the psychological handle at 100.00.

- The immediate bullish view in the index is expected to remain unchanged while above the key 55-day SMA, today at 98.19.

DXY daily chart