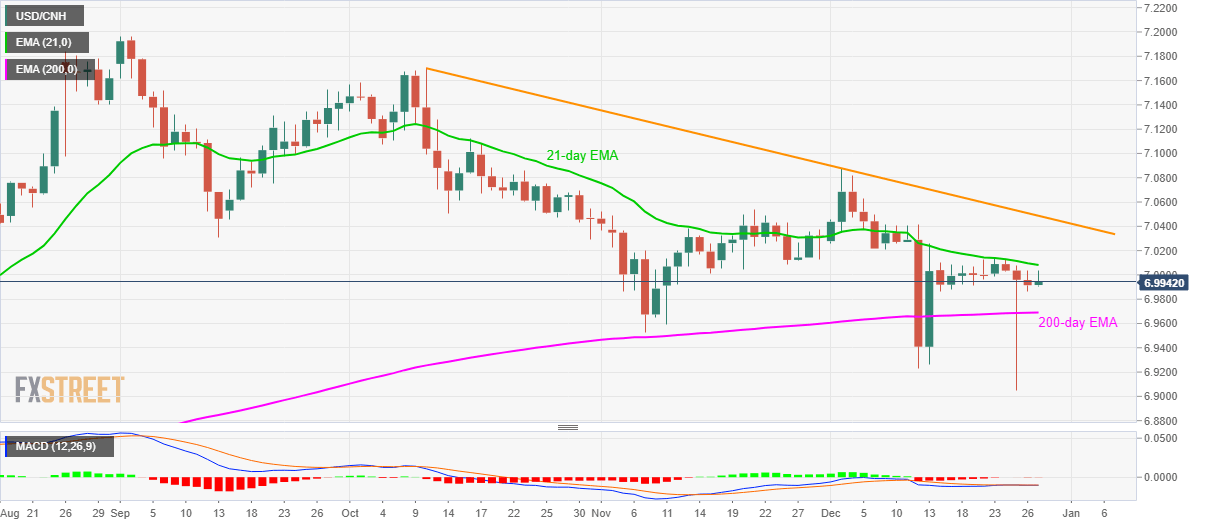

USD/CNH Technical Analysis: Stays below 21-day EMA after Friday’s PBOC fix

- USD/CNH remains on the back foot below 21-day EMA, a two-month-old falling trend line.

- 200-day EMA acts as immediate key support.

- PBOC increased CNY fix after a surprise cut on the previous day.

USD/CNH declines to 6.9925 amid China open on Friday. The pair bears the burden of the People’s Bank of China’s (PBOC) Yuan fix off-late while trading below 21-day Exponential Moving Average (EMA).

Read: PBOC sets Yuan reference rate at 6.9879

A 200-day EMA level of 6.9691 seems to be the short-term strong support to watch during the pair’s further declines.

However, pair’s slip beneath 6.9691 might not refrain from visiting lows marked in November and recently around 6.9520 and 6.9220 respectively.

On the upside clearance of 21-day EMA level of 7.0081, a downward sloping trend line since October 10, at 7.0487 now, becomes the key to watch.

On the pair’s sustained rise past-7.0487, a monthly top near 7.0880 will be on the Bull’s radar.

USD/CNH daily chart

Trend: Bearish