USD/JPY Price Analysis: Remains vulnerable near 2-week lows, just above 107.00 mark

- USD/JPY remained depressed on Monday and fell below 107.35-30 support zone.

- Some follow-through selling below 107.00 mark needed to confirm bearish outlook.

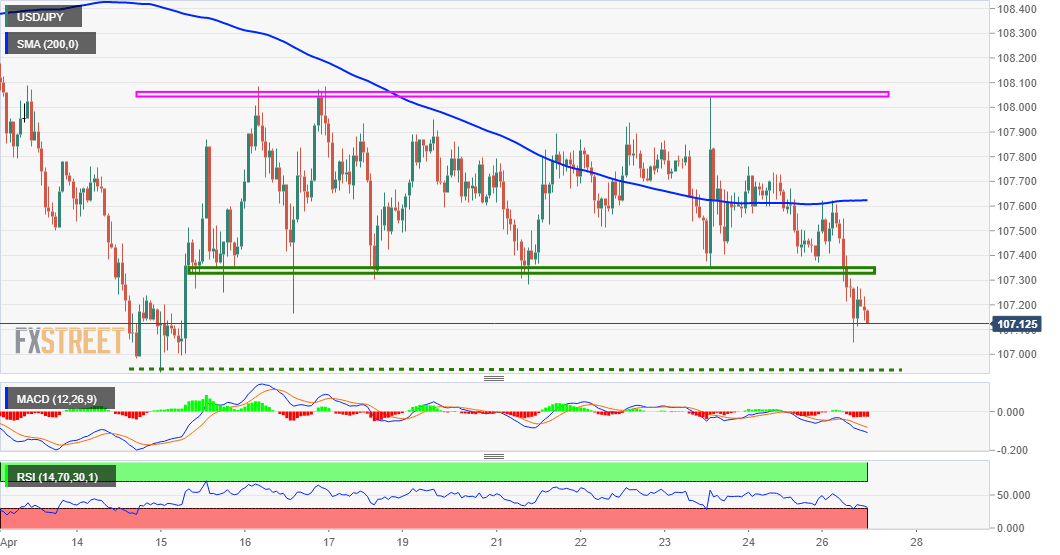

The USD/JPY pair extended last week's retracement slide from the 108.00-108.10 supply zone and dropped to near two-week lows on the first day of a new trading week.

The intraday selling pressure dragged the pair further below the 107.35-30 horizontal support, albeit bulls showed some resilience near the 107.00 round-figure mark.

This is closely followed by monthly lows support, near the 106.90 region, which if broken should pave the way for a further near-term depreciating move for the pair.

Meanwhile, technical indicators on the daily chart maintained their bearish bias and support prospects for an eventual break through the mentioned support levels.

However, oscillators on the 1-hourly chart have moved on the verge of breaking into the oversold territory and seemed to be the only factor lending some support.

Hence, it will be prudent to wait for some strong follow-through selling before positioning for a slide towards 106.40 intermediate support en-route sub-106.00 levels.

On the flip side, any attempted bounce might confront resistance near the 107.30-35 support breakpoint and seems more likely to remain capped near the 107.75 supply zone.

The 108.00-108.10 region might continue to act as a major hurdle, above which a bout of short-covering might assist the pair to aim towards reclaiming the 109.00 mark.

USD/JPY 1-hourly chart

Technical levels to watch