WTI Price Analysis: Snaps two-day losing streak, but still below $24.00

- WTI Futures for June registers over 1.0% gain after two-day declines.

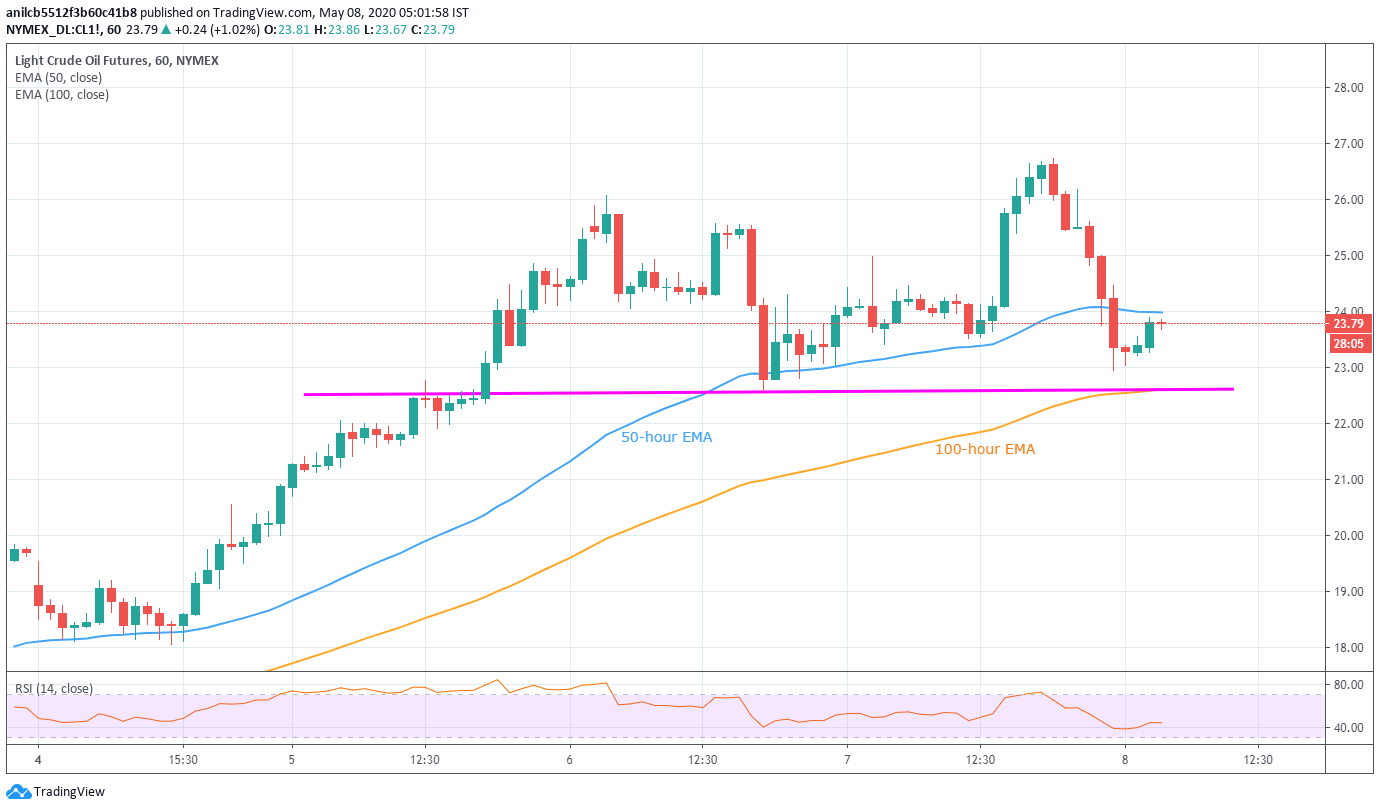

- 50-hour EMA acts as the immediate resistance ahead of Wednesday’s top.

- $22.60/55 acts as short-term key support.

WTI Future on NYMEX takes the bids near $23.80, up 1.0% on a day, ahead of Friday’s Tokyo open. In doing so, the black gold defies the previous two-day downside.

Considering the gradually recovering RSI, the energy benchmark could extend the latest recoveries towards a 50-hour EMA level of $24.00. Though, a break of which will help buyers challenge Wednesday’s top near $26.10.

It should also be noted that the quote’s sustained run-up past-$26.10 can refresh the monthly high beyond $26.70 to aim for April month top around $29.20.

On the flip side, a confluence of 100-hour EMA and multiple levels since the week’s start offer strong support around $22.60/55.

If sellers manage to dominate past-$22.55, $20.00 will be the next target for them.

WTI hourly chart

Trend: Further recovery expected