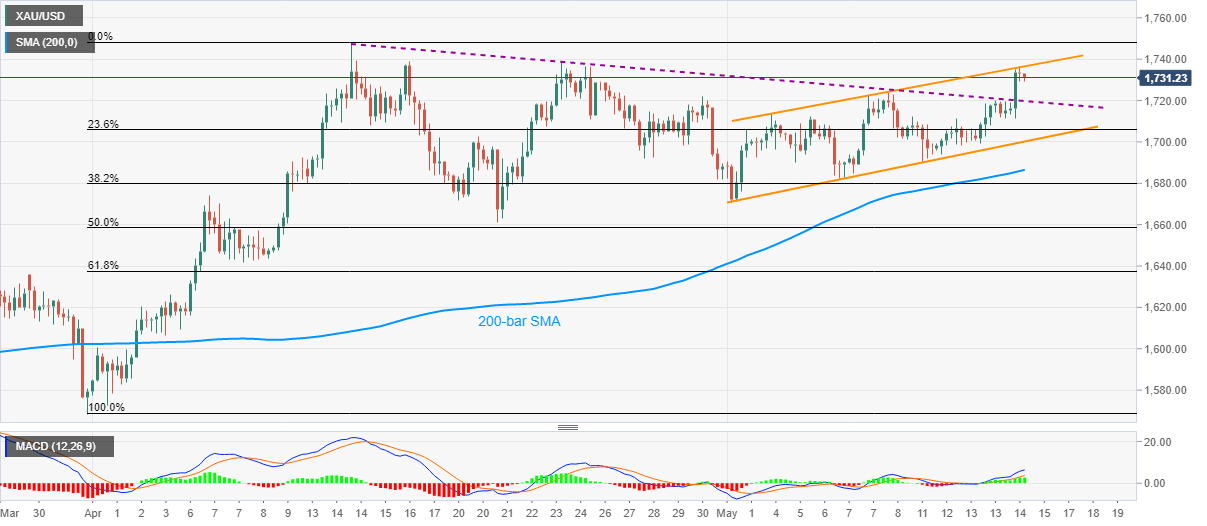

Gold Price Analysis: Eases from monthly rising channel resistance, above $1,700

- Gold retraces from a three-week high, but still keeps the short-term trend line breakout.

- Bullish MACD, sustained trend line break keep buyers hopeful.

- 200-bar SMA adds to the support below the channel’s lower line.

Gold prices retreat from multiday high to $1,731 ahead of the Tokyo open during Friday’s Asian session. Even so, the monthly ascending trend channel and a sustained break of the one-month-old falling trend line, coupled with bullish MACD, keep the traders positive.

As a result, fresh buying can take place beyond the channel’s resistance line of $1,737, which in turn will target April top near $1,748.

Though, the metal’s ability to successfully trade beyond $1,748 enables it to challenge the year 2012 top close to $1,796/97.

Meanwhile, the resistance-turned-support line near $1,720 gains the intraday sellers’ attention ahead of the said channel’s lower line, at $1,700 now.

In a case where the bullion prices slip below $1,700, 200-bar SMA near $1,686 can question the bears.

Gold four-hour chart

Trend: Pullback expected