Back

3 Jun 2020

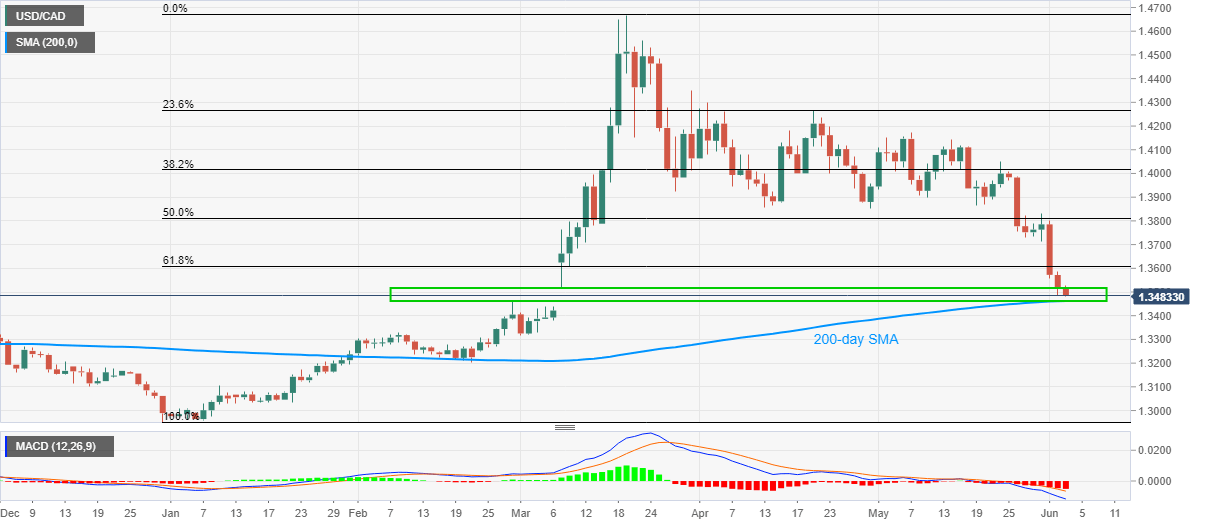

USD/CAD Price Analysis: Drops to fill the 13-week-old gap below 1.3500

- USD/CAD refreshes the 12-week low to 1.3480 amid bearish MACD.

- 200-day SMA, February top might question the immediate declines.

- 61.8% Fibonacci retracement limits the nearby pullback moves.

USD/CAD stands on a slippery ground while declining to 1.3480, down 0.26% on a day, during the Asian session on Wednesday.

While declining to the lowest since early-March, the pair fills the gap between March 06 and February 28 while also testing 200-day SMA.

As a result, the pair is likely to catch a breather around 1.3465/60 area comprising February month high and 200-day SMA.

Should the bears reject 1.3460 support, March 2020 low of 1.3315 will be on their radars.

Meanwhile, 61.8% Fibonacci retracement level of December 31, 2019, to March 19, 2020 upside, near 1.3610, restricts the pair’s near-term recovery moves.

USD/CAD daily chart

Trend: Pullback expected