Gold Price Analysis: XAU/USD drops below $1,800, next key support aligns at $1,780

- XAU/USD came under strong bearish pressure in early American session.

- Next near-term support is located $1,790 ahead of $1,780.

- $1,800 could be seen as the first hurdle.

The XAU/USD pair turned south in the early trading hours of the American session and dropped to a two-day low of $1,797. The sharp upsurge witnessed in the 10-year US Treasury bond yield provided a boost to the greenback and weighed on the pair. As of writing, XAU/USD was down 0.75% on the day at $1,792.50.

Gold technical outlook

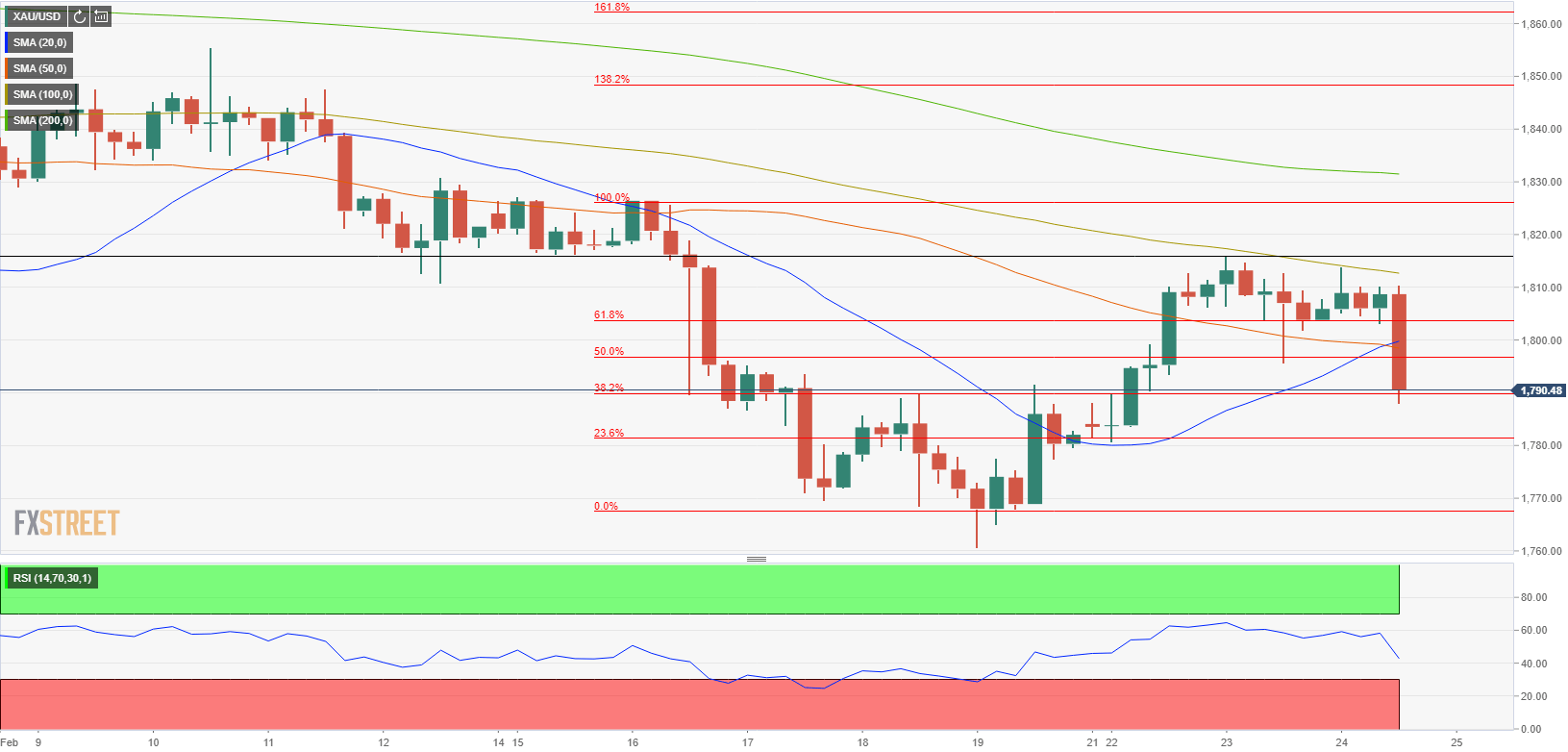

With the latest decline, the Relative Strength Index (RSI) indicator on the four-hour chart dropped below 50, suggesting that the bearish momentum is building up in the near-term.

On the downside, the initial support is located at $1,790, where the Fibonacci 38.2% retracement of the last week's drop its located. If a four-hour candle manages to close below that level, gold could extend its slide to the next Fibo level (23.6% retracement) at $1,780.

On the other hand, $1,800 psychological level, which is reinforced by the 20 and the 50 SMAs, aligns as the first hurdle ahead of $1,812 (100 SMA) and $1,815 (static level/Feb. 23 high).

Gold four-hour chart

Additional levels to watch for

Additional levels to watch for