EUR/GBP Price Analysis: Bulls look to validate run-up towards 0.8700, UK budget in focus

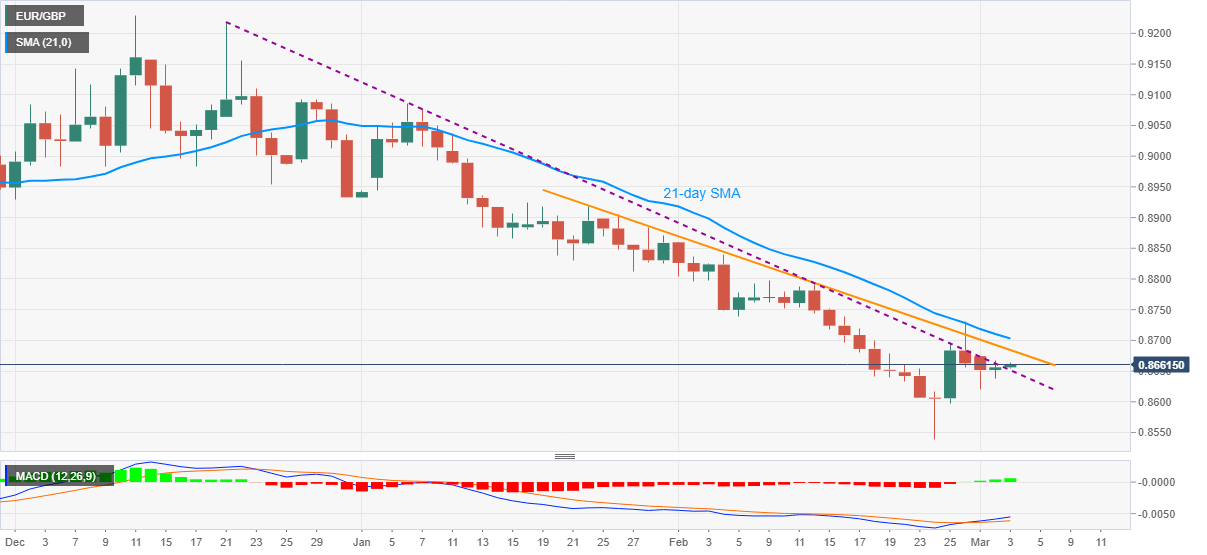

- EUR/GBP wavers around intraday top after breaking 10-week-old resistance the previous day.

- Short-term resistance line, 21-day SMA stands tall to test the bulls amid upbeat MACD.

- Bears will eye breakdown of 0.8600 for fresh entries.

EUR/GBP prints mild gains while struggling to keep the bulls hopeful around 0.8660 during the pre-European session on Wednesday. The pair becomes key for the day considering the scheduled release of Eurozone PMIs and the UK budget.

Given the high hopes from the British budget, any disappointment in the form of a future tax hike could derail the upbeat sentiment.

However, technical formations favor buyers after the pair crossed a descending trend line from December 21 the previous day.

The moves also gain support from the bullish MACD, which in turn directs EUR/GBP optimists to the next key hurdles, namely a descending trend line from January 22 and 21-day SMA, respectively around 0.8685 and 0.8705.

Meanwhile, EUR/GBP sellers are less likely to return unless witnessing a daily closing below the 0.8600 round-figure, following that the multi-month low flashed last week near 0.8540 will be the key to watch.

Overall, EUR/GBP has already flashed initial signals for a trend change that need confirmation.

EUR/GBP daily chart

Trend: Further upside expected