US Dollar Index clings to gains near 92.00 ahead of data

- DXY extends the move higher and approaches 92.00.

- US 10-year yields keep business near the 1.60% level.

- Retail Sales, Industrial Production next of relevance in the US docket.

The greenback, in terms of the US Dollar Index (DXY), extends the multi-session recovery to levels just shy of the key barrier at 92.00 the figure.

US Dollar Index focused on yields, data

The index advances for the third consecutive session and gradually challenges the key 92.00 neighbourhood in the first half of the week.

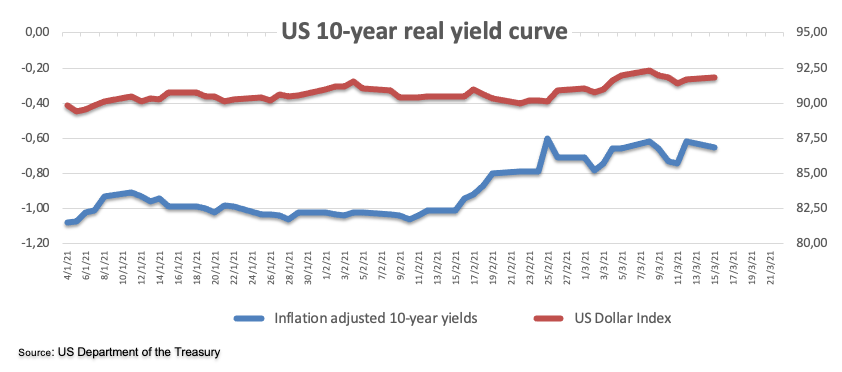

The dollar keeps looking to the performance of the US bond market for direction, where yields of the key 10-year note stay close to recent tops above the 1.60% area. In fact, yields recovered ground after discouraging inflation figures for the month of February cooled down higher inflation expectations and motivated a knee-jerk in both yields and the buck during last week.

In the meantime, the outperformance of the US economy vs. its peers coupled with the recently approved stimulus package, rising perception of higher inflation in the next months and the firm pace of the vaccine campaign in the US all continue to lend support to the dollar.

It will be an interesting day data wise, as February’s advanced Retail Sales are due seconded by Industrial/Manufacturing Production during the same period, the NAHB Index and Business Inventories.

In addition, the Federal Reserve will start its 2-day monetary policy meeting, with the decision on the Fed Funds target range expected on Wednesday.

What to look for around USD

The change of heart in the buck seen in past weeks remains underpinned by the expected better performance of the US economy vs. its G10 peers. The fresh stimulus aid is also seen adding to the latter pari passu with the investors’ perception of higher inflation in the months to come and its translation into rising US yields. However, a sustainable move higher in DXY should be taken with a pinch of salt amidst the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery.

Key events in the US this week: Retail Sales/Industrial Production (Tuesday) – FOMC event (Wednesday) – Initial Claims/Philly Fed Index (Thursday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.05% at 91.88 and a breakout of 92.50 (2021 high Mar.9) would expose 92.75 (200-day SMA) and finally 94.30 (monthly high Nov.4). On the other hand, the next support emerges at 91.36 (weekly low Mar.11) seconded by 91.05 (high Feb.17) and then 90.75 (50-day SMA).