Gold Price Analysis: XAU/USD remains stuck between key levels, holds around $1,730

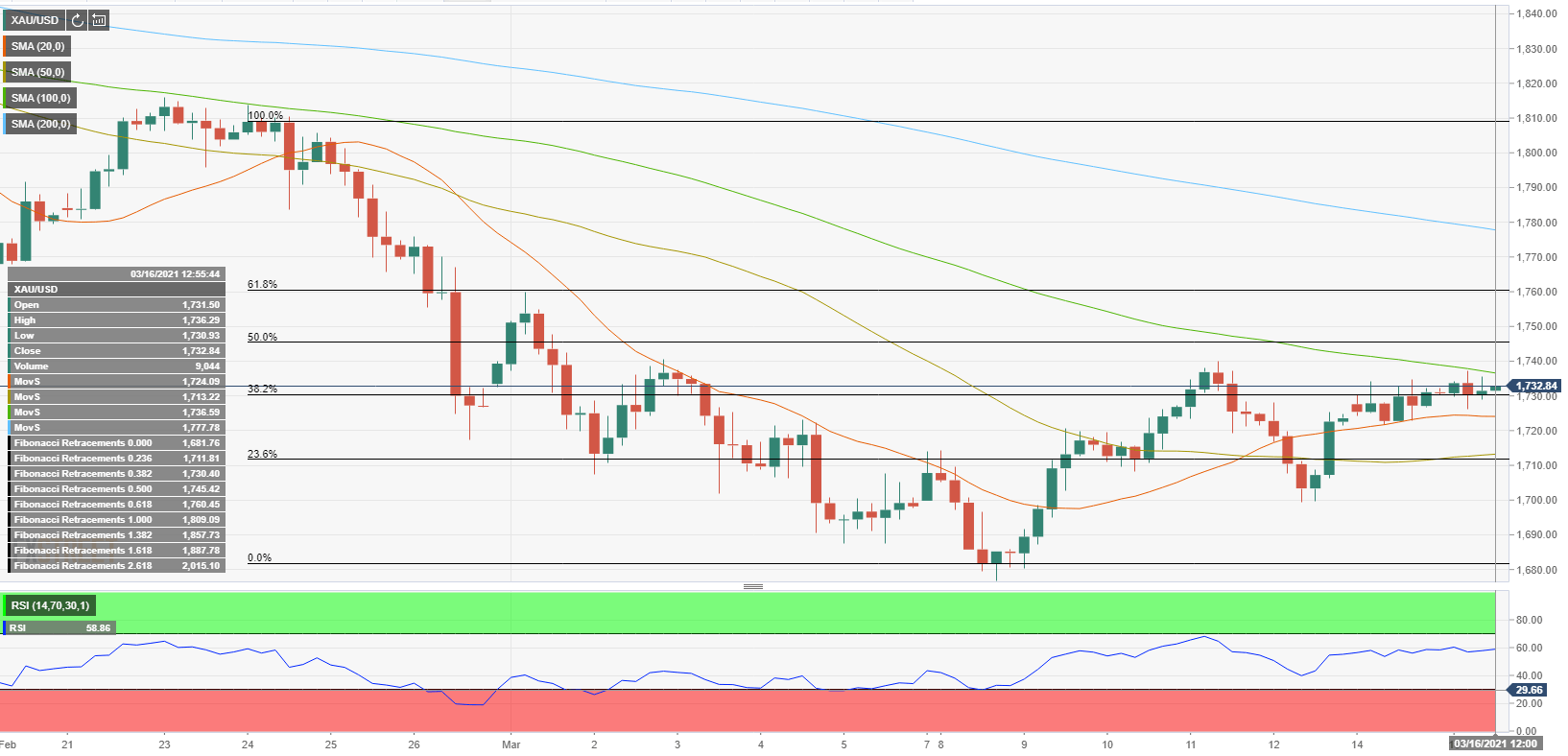

- XAU/USD is trading in a very narrow band for second straight day.

- Buyers could target $1,745 if gold manages to clear $1,736 resistance.

- $1,710 aligns as the initial support before $1,700.

The XAU/USD pair closed the first day of the week with small gains at $1,730 and seems to be having a difficult time setting its next short-term direction. As of writing, the pair was up 0.12% on the day at $1,734.

Gold technical outlook

On the four-hour chart, the 100-period seems to have formed near-term resistance for gold at $1,736. With a four-hour candle closing above that level, $1,745 (Fibonacci 50% retracement of the Feb. 23-Mar. 8 decline) could be seen as the next target on the upside.

On the other hand, the initial support is located at $1,730 (Fibonacci 38.2% retracement) ahead of $1,710 (50-period SMA, Fibonacci 23.6% retracement) and $1,700 (psychological level).

In the meantime, the Relative Strength Index (RSI) indicator on the same chart is moving sideways near 60, suggesting that the near-term outlook remains neutral/bullish.

Additional levels to watch for