AUD/JPY Price Analysis: Bounces off key support confluence towards 84.00

- AUD/JPY picks up bids from intraday low during second consecutive daily drop.

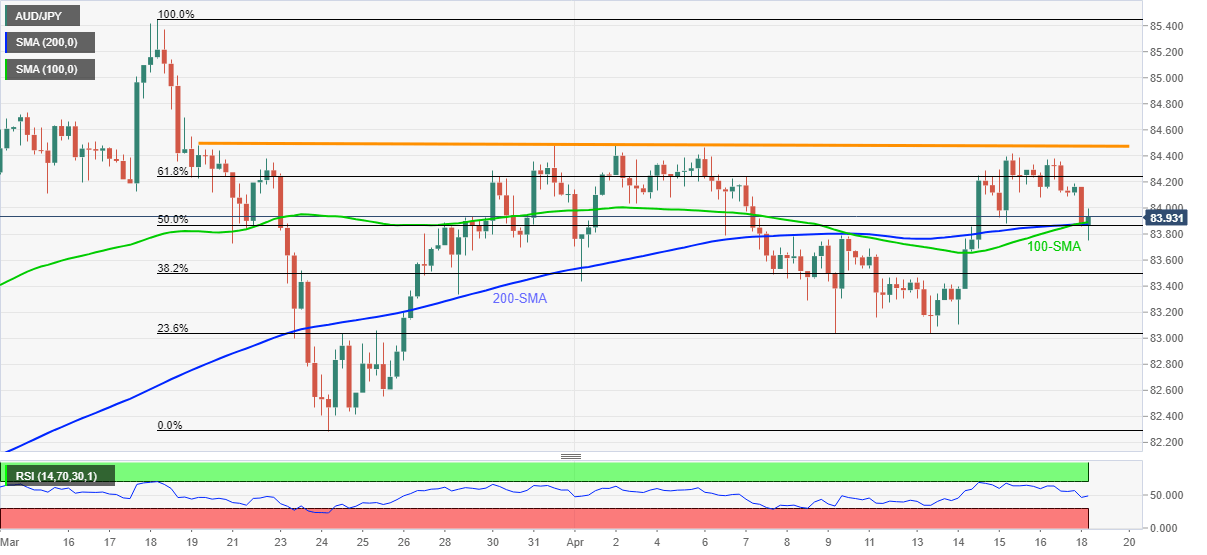

- 100 and 200-SMAs join 50% Fibonacci retracement of late March drop to test sellers.

- Key Fibonacci Retracement, one-month-old horizontal resistance challenge recovery moves.

AUD/JPY takes a U-turn from 83.75 while trimming the intraday losses to 0.30%, around 83.91 by the press time of early Monday.

Following its pullback moves last Thursday, the quote remains pressured. However, a confluence of 50% Fibonacci retracement, 100-SMA and 200-SMA, near 83.85, recently triggered the pair’s bounce.

Even so, downbeat RSI conditions keep challenging the recovery moves before a 61.8% Fibonacci retracement level of 84.23.

It should also be noted that a clear break above the key Fibonacci retracement level will be challenged by the 84.50 horizontal resistance line established on March 19.

Meanwhile, 83.50 and 23.6% Fibonacci retracement level around the 83.000 threshold can lure the AUD/JPY sellers during the fresh declines. However, any further weakness may target March 24 low near 82.30.

AUD/JPY four-hour chart

Trend: Further weakness expected