Gold Price Forecast: Bulls stepping off the gas in meeting daily resistance

- Gold move sin to test the bearish commitment at a daily counter trendline.

- All eyes are on the Fed this week while the US dollar gives back a significant portion of the recent surge to the upside.

- XAU/USD’s drop below $1,780 an ominous sign ahead of Fed

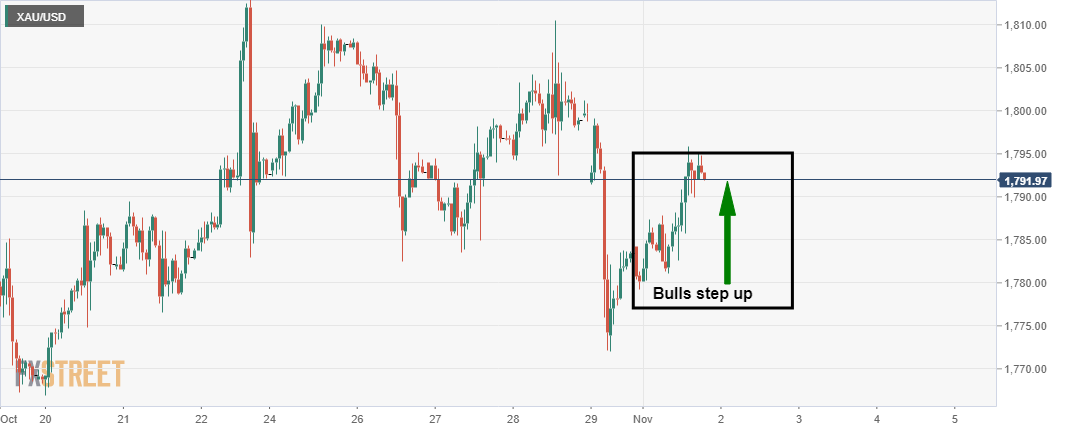

The price of gold is some 0.6% higher on the day following a solid climb into daily resistance in the highs of the day of $1,795.82. XAU/USD has travelled from a low of $1,779.23 while the US dollar eased versus its main rivals on Monday.

The greenback has corrected a significant portion of the biggest daily rise in more than four months which occurred in the previous session. Hedge funds are cutting back bearish bets ahead of this week's highly-anticipated US Federal Reserve policy meeting where the Fed is widely expected to announce its tapering plans.

Fed in focus

''Financial markets are priced aggressively for hikes in 2022, but the Fed is unlikely to endorse or push back on those expectations at this point as we await more inflation evidence,'' analysts at Societe Generale argued. We also have US Employment trends in focus and these are expected to regain momentum. The analysts at Societe general are anticipating a 520k job gain for Nonfarm Payrolls at the end of this week.

Staying with the Fed, traders across global markets have aggressively raised their outlook for policy tightening, as an energy crunch and snarled supply chains drive inflation higher, leading market participants to price the risk of a faster exit.

Analysts at TD Securities note that US Treasuries are pricing in the first hike by July 2022 and a 90% chance of a hike in June, despite the fact that tapering is on course to only end by June.

''We reiterate that pricing for Fed hikes remains far too hawkish, but insofar as the outlook for actual hikes becomes increasingly dependent on the Fed's jobs mandate, this week's nonfarm payrolls number could steal the show, the analysts added. Nonetheless, they say, ''as an ongoing CTA selling program winds down, recent pressure on gold could soon abate.''

Gold technical analysis

The moves on Monday have undermined the opening bearish bias seen at the start of the week with the grind to the upside as follows:

As illustrated, the downside prospects were eliminated with a conservative bid as London opened up which has seen the price move in on daily resistance as follows:

The price is now at a crossroads whereby a break of the neckline of the M-formation will leave a bullish bias for the days ahead, while a rejection at the counter trendline will put the bears back in charge.