GBP/JPY Price Analysis: Bears are lurking in monthly structure, 163.50 support eyed

- GBP/JPY rallies into a prior monthly support area.

- GBP/JPY bears are potentially looking for an opportunity in a reversion of the current bullish phase.

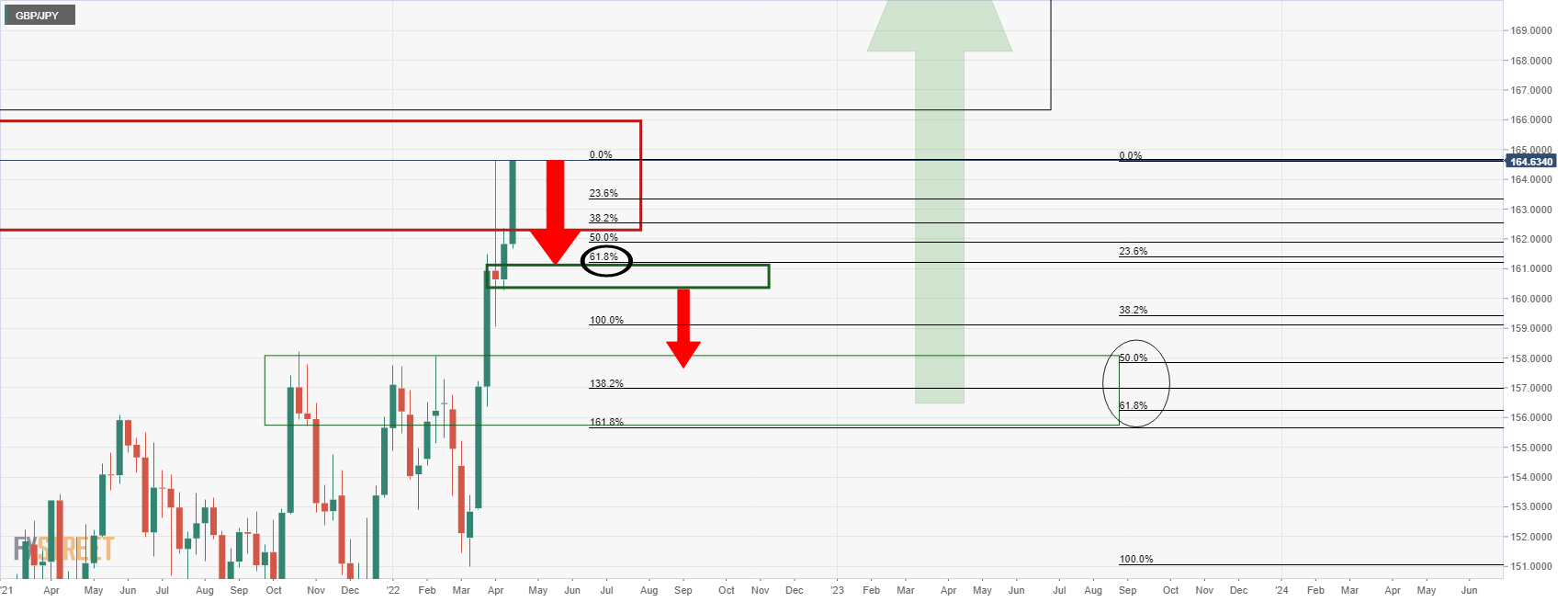

GBP/JPY has rallied by almost 1% on the day in an extension of the bullish breakout of the 2021 resistance as per the monthly chart. However, whether the price can continue into the next mitigation zone without a prior retest of the old resistance area is the question:

GBP/JPY monthly chart

As illustrated, the price has rallied into an old level of monthly support that would now be expected to act as a resistance area and guard the next imbalance of price which occurred when GBP/JPY fell in 2016 to below 175 the figure. In May 2016, the price recovered back to 164.03 for which the current cycle has returned to and slightly beyond in printing today's highs of 164.59.

If the bulls stay in control, then the next area of mitigation will be towards 175 the figure for the weeks and months ahead. However, if the bulls throw in the towel anytime soon, a 50% reversion could be on the cards first which is a touch below 158.00. However, the bears will need to get beyond the weekly support as follows:

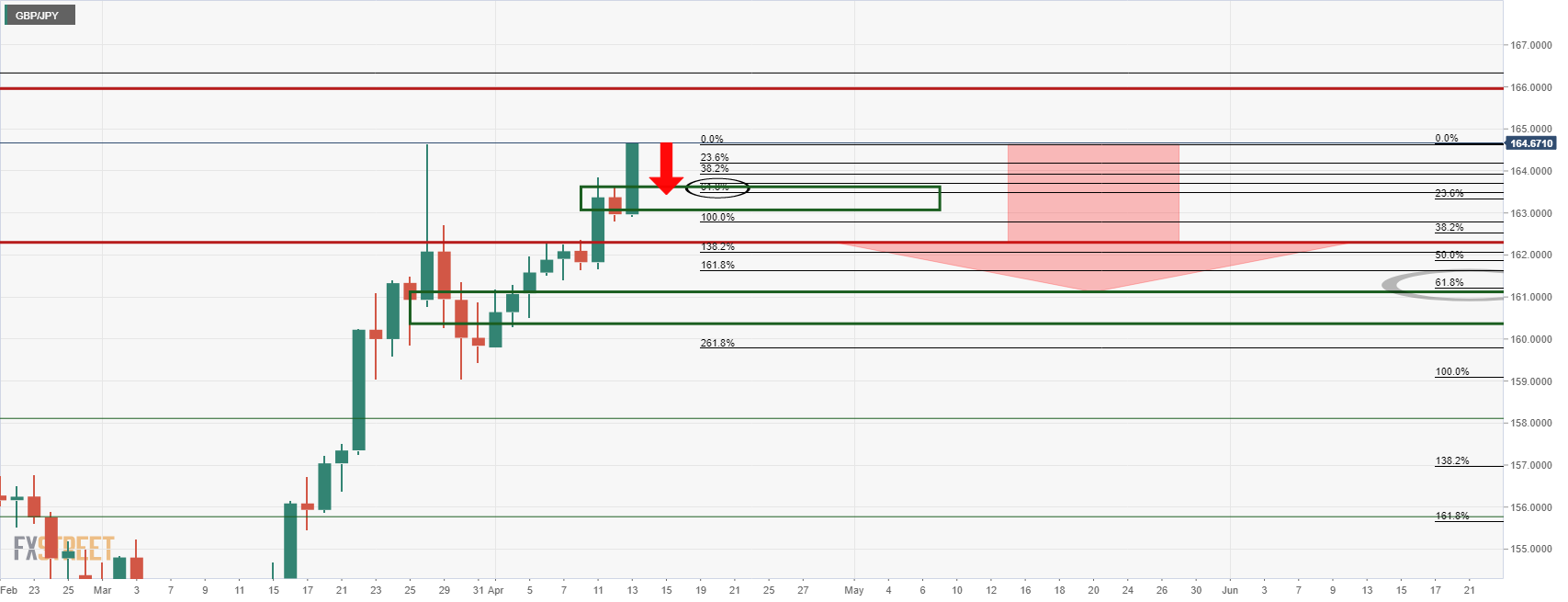

GBP/JPY weekly chart

The price is meeting the March 28 highs and should it now turn south, then the 61.8% Fibonacci near 161.20 could be eyed where it meets the weekly structure. before there, however, the daily support will be challenged near 163.50:

GBP/JPY daily chart